Blog

How Medical Debt May Be Hurting the Housing Market

December 20, 2019

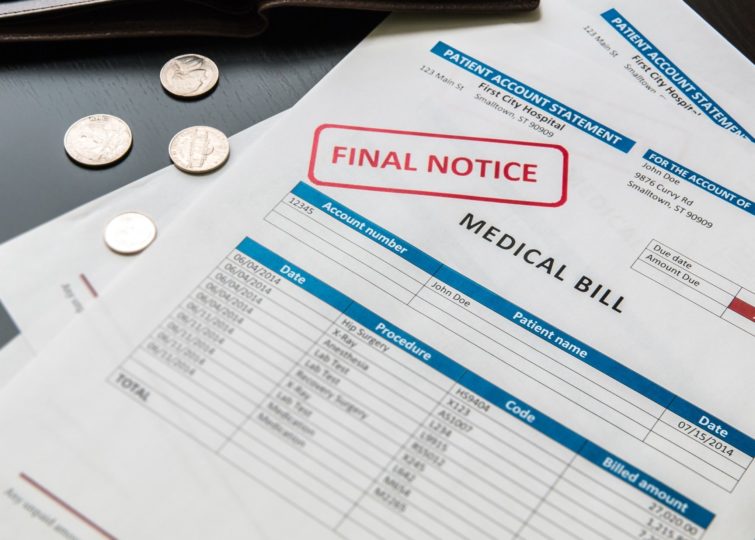

While all forms of debt impact someone’s credit score, medical debt, in particular, seems to be making it harder for many Americans to get a mortgage. Prospective buyers with medical debt are more likely to be denied a mortgage, according to a recent report from Zillow.

The survey found that 38 percent of buyers who owe money for medical expenses said they had their mortgage application rejected because of their debt. Just 28 percent of those with student debt were rejected, and only 22 percent of those with credit card debt had their application denied.

The same survey found that those with medical debt are less prepared for unexpected expenses. The survey found that about half of all renters and 20 percent of all homeowners said they wouldn’t be able to cover a $1,000 emergency expense. For those with medical debt, the numbers jump to two-thirds of renters and 44 percent of homeowners.