Blog

How Is the Surge in Lumber Prices Impacting the Housing Market?

May 10, 2021

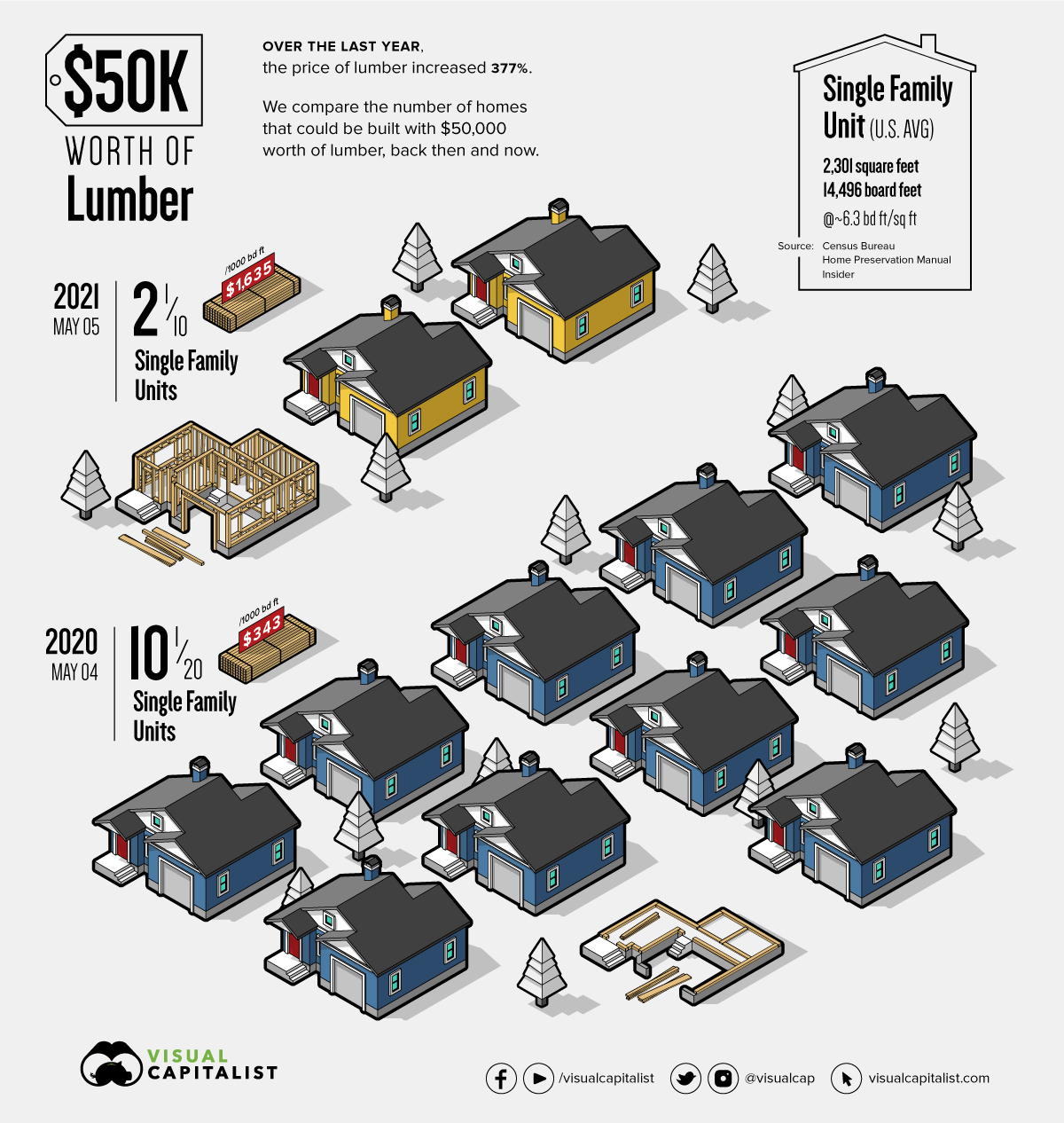

Over the last year, the price of lumber has exploded. The price for 1000 board feet (bd ft), the standard unit to track prices in the industry, has climbed 377% to a record high of $1,635. Historically, prices fluctuate between $200 and $400.

To demonstrate just how much of an impact this spike in prices has on the housing market, Visual Capitalists looked at how many homes could be built with $50,000 in lumber today and last year.

As you can see, the average single-family home is 2,301 and requires 14,496 bd ft of lumber. This means that last year, when lumber was $343 per 1000 bd ft, $50,000 would buy enough lumber for more than 10 homes. Today, $50,000 would buy enough lumber for a little more than two homes. This means fewer homes built at higher prices, with a housing market already facing historically low inventory and high prices.

The reason prices are so high is something of a perfect storm, with multiple factors contributing. In 2017, tariffs were placed on Canadian lumber imports, causing increased price volatility, leading to the closure of some sawmills. Then, the pandemic started and labor shortages cut production further. At the same time, pent-up demand has led to a boom in the housing market, greatly increasing the need for lumber.

Demand is expected to continue outpacing supply for the remainder of the year, keeping prices high. Analysts are now worried that lumber prices could hit a flashpoint where prices become so high that demand suddenly drops off.