Blog

Visualized: Global Inflation and Interest Rate Forecasts

May 2, 2024

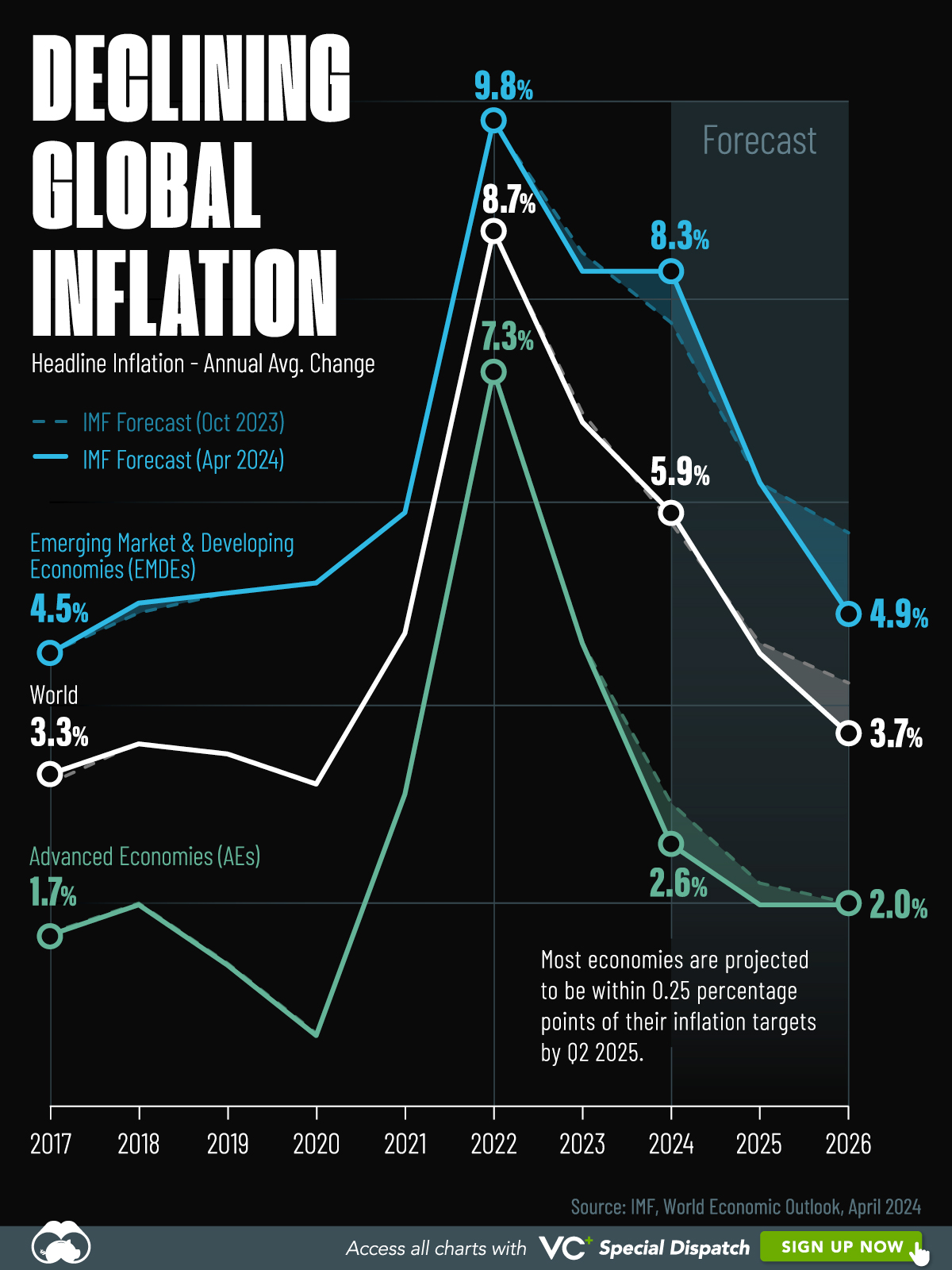

Global inflation has retreated significantly from the multi-decade highs we have seen in recent years, but progress in the fight against climbing prices has slowed in recent months. The big question facing investors and central bankers alike is if inflation will decline far enough to allow for lower interest rates and easier monetary policy.

Looking ahead, the International Monetary Fund (IMF) is projecting that inflation will continue to decline, but the path to disinflation may not be equal for all economies and unknown risks remain. Below is a graph compiled by Visual Capitalist charting the IMF’s projections for inflation in the coming years.

As can be seen, the world’s developed economies will see inflation return to their target ranges (generally 2%) by the middle of 2025. The course that these projections will take is extremely fragile, however. Inflation has largely declined due to falling energy and goods prices, but persistently high services inflation poses challenges to mitigating price pressures. In addition, the IMF points to the risk of an escalating conflict in the Middle East or other geopolitical strife, which could cause energy price shocks and higher shipping costs amid trade disruptions.

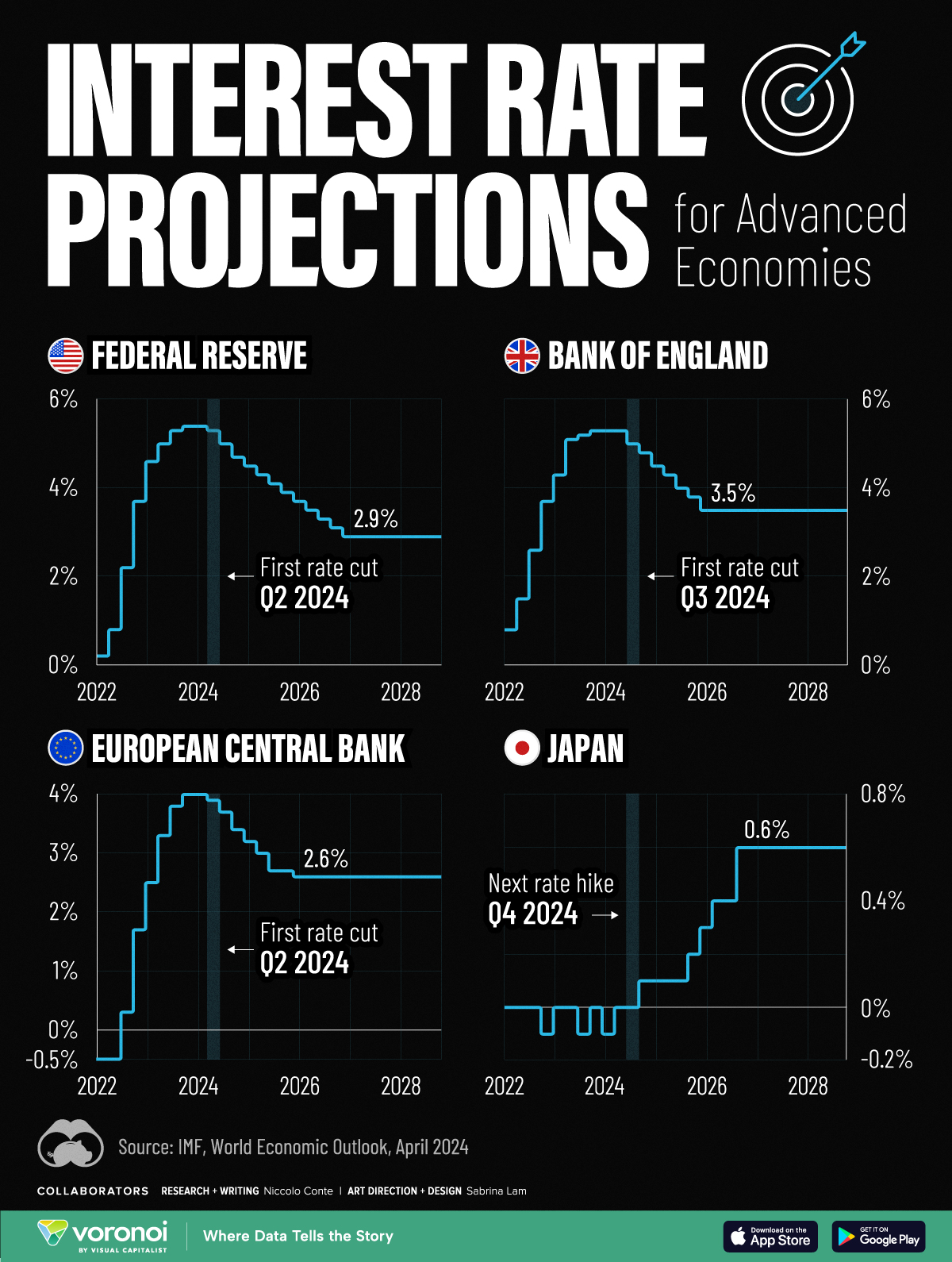

Still, the presumed path that inflation is projected to take will clear the way for central banks to begin cutting interest rates, the IMF forecasts of which Visual Capitalist has again charted below.